Switch to my other substack....great content there!

I have a great newsletter over at a different website - subscribe now before you have to pay

I’ve only just realized that I forgot to merge this website with my main newsletter which is now working over at davidstevenson.substack.com. Here you’ll find my regular newsletter which has three editions every week - a macro edition, investment ideas on Wednesdays, and a Friday further reading links report.

At some point, I will start charging but for now it’s completely free. So go ahead and switch that subscription on…

As a taster, below you’ll be able to read today’s Friday further reading LINKs.

Kids

I’ve always slightly worried about who’s advising the wonderful Katharine Birbalsingh, head of the wonderful Michaela Community school. She’s clearly an inspirational teacher and leader but she’s also very media savvy and has acquired a lot of friends on, how shall I put this politely, the contrarian end of the Conservative Right. This has made her a lightning rod for ‘experts’ across the left who – let’s be honest – dominate the educational establishment. She needs to engage with more folk from the centre and centre left who almost certainly – like me – I agree with the value of her methods. Frankly, much of what she says makes so much sense that one wonders why anyone would disagree – but of course, those political ‘associations’ will substitute for real substantive criticism. My own view is to listen to the evidence and make up your own mind.

On this score, I heartily recommend an excellent, really quite heartfelt piece by Rob Henderson

It’s in turn synced around the launch of a new documentary out about the Michaela Community School.

“Originally titled “The Unspeakable Truth About Children,” it was renamed to “Britain’s Strictest Headmistress.” I attended the premiere in London, and the documentary is now available here. I visited the Michaela School a few months ago, which has been called “the strictest school in Britain.” The school is located in Brent, an impoverished borough of London where one-third of households live in poverty. The students come from the local neighborhood.”

Rob’s blogs/newsletter is an excellent source of new ideas and original insights. But this piece is especially interesting as he also goes into huge detail about his own background which is, to put it bluntly, fairly difficult and troubling. Which is why you sense he feels more sympathy for Katharine’s approach…which clearly works because of its rules based, participative, encouraging approach.

“The idea is that yes, kids do dumb stuff sometimes, but there is a difference between acknowledging this reality and having no rules at all. Some say that because poor kids are at a disadvantage in learning the rules for how to behave well, we should eliminate the rules. Conveniently, this excuses not only the children who act out, but the adults for not enforcing standards. Others say we should teach the kids the rules. This is much harder. The teachers at Michaela were switched on and far more alert than most of the teachers I had. They quite clearly care about the kids. After lunch two kids took me on a tour of the school. When I introduced myself, I was about to say, “My name is Rob,” before remembering the name tag the school gave me had “Mr. Henderson” on it. I asked the kids if they ever wished the school was less strict. They said no, they liked the rules and expectations.”

You can support the school here. The documentary about the school is available here.

Shorts

Let’s be honest, most investing is boring. I think it was the economist Paul Samuelson who is alleged to have said that Investing should be more like watching paint dry or watching grass grow – although he clearly hasn’t seen my garden recently where the grass (and nettles) seem to be growing like crazy. Anyway, investing should be boring but some of the biggest gains – and losses – are made in stocks that are controversial. Dare I say hated. These Marmite stocks are fascinating and appeal to our speculative nature. I personally like trawling through the list of 52-week price lows to find stuff I like.

Another useful exercise is to look down the list of the most shorted stocks – and check you don’t own any! On this score, ETP provider GraniteShares – which offers a range of 3x short and 3x leveraged ETPs on popular UK, US, and European stocks – has recently (19th May) published its latest list of most shorted stocks. Top of the shorts is Cineworld Group, the world's second-largest cinema chain, which was the most shorted UK listed company. Some 8.2% of its stock was held short by five investment firms. Next up we have ASOS PLC, Dixons Carphone PLC and BOOHOO.com with 7.2%, 6.4% and 6.2% of their stock held short by 8, 6 and 7 investment firms respectively. The table shows the largest ten short positions in companies that are listed and trading on the London Stock Exchange.

You can pretty quickly see a theme here – retail. This in turn suggests that investors are betting on a recession imminently. I don’t follow most of the stocks on this list but I do know a few things about Boohoo (god my kids buy so much from there), ASOS and AO World. All three strike me as perfectly sound, cash generative businesses that just so happen to be in the wrong place at the wrong time.

Quality Stocks

Late last year analysts from Amundi published a long old research paper on the subject of quality stocks. Arguably now is a good time to be thinking again about what constitutes a quality stock. We are about to enter a recession and presumably some listed firms will be in deep trouble. Some firms, on the other hand, will prosper and one assumes that quality firms are the businesses that will thrive the most. Which brings us nicely to the paper which is called Revisiting Quality Investing by Frederic Lepetit, Amina Cherief, Yannick Ly, and Takaya Sekine.

They’ve clearly spent many long, boring hours, staring at massive data sets to test out their ideas – he data set is over a period of eighteen years and consists of a universe of global developed markets liquid stocks (large- and mid-caps).

In a long-short framework, our quality factor delivers a statistically significant alpha that cannot be explained by loadings on conventional equity factors (market, value, size and momentum). Most regions and dimensions display positive contribution to this alpha, with the noticeable exceptions of the Eurozone region and the safety dimension.

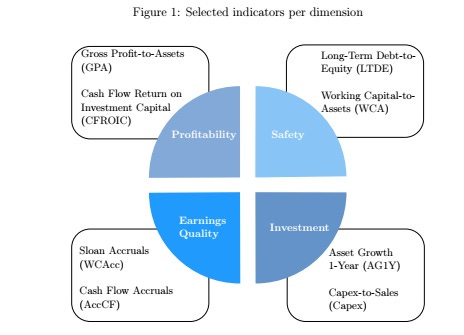

Crucially the authors go into quite some detail about how to define quality – a broad description that I think sometimes confuses more people than it assists. The graphic below I think nicely sums it up – there are, in reality, four distinct groupings of metrics about what constitutes a quality stock, namely profitability, safety, earnings quality, and investment.

Usefully the team found that by combining all four factors in one model, we get the best results.

“In a long-only framework, our quality factor outperforms its benchmark by 2.8% per annum over the entire analysis period, with an information ratio of 0.81. Furthermore, the outperformance has been very consistent since the 2008 Global Financial Crisis (GFC).

“The four dimensions are weakly correlated with each other and are therefore complementary. We show that safety is of particular importance during periods of market turmoil (GFC, Covid-19 pandemic) and that the dimension is therefore part of the quality factor in its own right. “

Taiwan

OK, I think we need to talk about black swans, grey rhinos, and other mythical creatures that haunt the imagination of investors. Geopolitics ahs proved, yet again, that it can provide some very nasty surprises and reminded us that some political leaders don’t always behave like we expect them to.

This brings us to China. I think the single greatest lesson of the last few years is that President Xi is not gods gift to technocratic leadership and has made many very big mistakes. Put simply, he looks out of his depth and in trouble. What happens next is really rather binary – does he learn from his mistakes and Deng style start to wise up or does he do a Mao and double down (yep the Great Leap Forward didn’t work but hey let’s give the Cultural Revolution a go). Surely the smart money ahs to be on the latter dire possibility. At which point Taiwan enters the frame. Maybe he’ll make the big play and finally teach those dastardly Taiwanese a lesson and also give the yanks a good kicking.

The Ukraine has, I would presume, informed some Chinese thinking but they might also want to read a wonderfully detailed paper on the difficulties of seaborn invasions by Mike “Starbaby” Pietrucha who retired from the Air Force as a colonel.

Here’s his biog : He was an instructor electronic warfare officer in the F-4G Wild Weasel and the F-15E Strike Eagle, amassing 156 combat missions over 10 combat deployments. As an irregular warfare operations officer, he has two additional combat deployments in the company of U.S. Army infantry, combat engineer, and military police units in Iraq and Afghanistan.

He’s published a cracking paper called Amateur Hour Part 1 on the invasion of Taiwan which can read here on the War on the Rocks website.

Mike starts by making the obvious parallel to Ukraine.

“…..any such action by China would likely run into a similar buzzsaw of resistance, while lacking Russian advantages such as access to overland transit. Ukraine is not Taiwan, and regardless of what Chinese leadership thinks they are learning about the benefits of naked aggression, the People’s Liberation Army lacks the necessary power projection and sustainment capability and capacity to execute an opposed occupation of a densely urbanized island packed with citizens who have no interest in living under Communist rule.”

Mike then goes into formidable detail about earlier examples of sea born assaults, focussing on the WW” invasion of Sicily by the Allied forces. Its conclusion :

“When we look at the Chinese equivalent, it becomes clear that the Chinese military simply does not have the naval assets or the auxiliary forces necessary to execute an amphibious operation on the necessary scale. The count of every PLAN amphibious ship currently operational or known to be under construction, plus naval troop-carrying auxiliaries, totals up to 128 ships of 744,370 tons, but their aggregate personnel, cargo, and vehicle capacity are less than half that of the older WWII vessels. Adding on the older PLA tank landing ships not owned by the Navy does not nearly make up the difference. Furthermore, the total PRC inventory of small landing craft is less than half of what the Americans had embarked off Sicily, limiting the size and number of landing waves. While the PLAN has helicopters ad Operation Husky did not, the PLAN is in the unenviable position of having fewer navalized transport helicopters than the theoretical capacity of their existing and planned fleet. Helicopters will not substitute for the personnel landing craft, although they can deliver payloads beyond the shoreline — in a benign environment.

“All told, it’s entirely clear that China lacks the capacity to match the American assault wave against Sicily, to say nothing of the entire Allied effort that included British and Canadian forces. While an analysis of the carrying capacity of the commercial vessels belonging to China (and Hong Kong) is beyond the scope of this paper, these ships are next to useless in an assault phase and come into play only if adequate, intact port facilities are captured.

“Furthermore, the degree of fire support required to deal with counterattacks against the beachhead is illustrated well by the successful American fire support off Gela, which today is impossible to replicate by any navy; even airpower lacks the capability to deliver the necessary volume of fire, particularly over time. And of course, the enemy gets a vote. The Americans landed among small towns manned by weak garrisons with a population that did not muster significant opposition and was unsympathetic to their own government. In Taiwan, as in Ukraine, invaders should realistically expect an aroused and angry population with a sizable and modern military willing to contest every inch of heavily urbanized territory. It’s here where the comparison to Sicily breaks down, and capacity questions aside, the idea of landing into an urban area and expecting any other result than an early and bloody defeat seems ludicrous. China would be lucky were it in a position akin to Allied forces when they assaulted Sicily.”

Of course, the open question is whether all of this common-sense might, in the end, makes no difference – as Mike says “there is no question that they could launch an unsuccessful one”.

Tractors

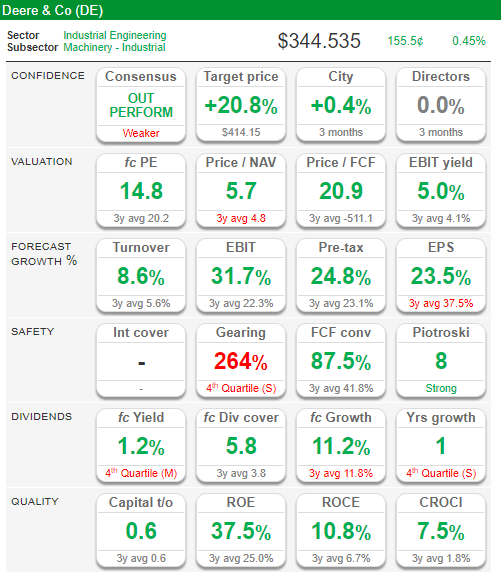

Deere and Co I think should be on most investors’ watch list. It’s a great business that is trying to pivot from making boring old diesel tractors into state-of-the-art automated agritech machinery of the future. Most companies have to do that pivot on venture capital’s dime but Deere can do that using the huge cashflows from selling expensive clunkers to equally wealthy farmers.

This brings us to their recent quarterly numbers which I thought were really rather good, with profits growing twice as fast as sales. Unfortunately, the wider market came to a different conclusion, as can be seen in this excellent Motley Fool summary here.

“Reporting its financial results for its fiscal second quarter 2022 Friday, Deere said its net sales and revenue came in at $13.4 billion, up 11% year-over-year. Earnings, however, rose 20% year-over-year, to $6.81 per share, exceeding sales growth thanks to a net profit margin that grew by nearly a full percentage point.

“Regardless, investors sold off Deere in droves. In just the first two hours of trading Friday, Deere stock fell 11.5%.... By all accounts, Deere is driving toward its most successful and profitable year ever. With demand high and rising, farmers likely to be flush on grain profits and well-able to afford new farm equipment, Deere beat earnings in Q2, and is promising to keep on beating earnings all year long.

And Motley Fools take ?

“Granted, at 13.8 times earnings, Deere looks a little bit expensive based on its projected 15% long-term growth rate and tiny 1.2% dividend yield. Still, on balance the earnings news looks good to me -- and a better reason to buy Deere stock than to sell it.”

I agree and here are some useful context setting charts – the first shows that the forecast PE is now down to 14.8, with a forecast dividend yield of 1.2%. Return on capital employed is running at around 10.8%.